Alternatives to Stripe for Indian Businesses

Stripe is a global favorite, but India is unfortunately not a focus for them. Limited local support, high transaction fees and compliance headaches often leave entrepreneurs searching for better options. Add to that the challenge of randomly blocked payouts and restricted features, and it’s no wonder people are still looking for the best International Payment Gateway for Indian businesses.

Let’s unpack the key reasons why Stripe isn’t always the perfect fit for India’s dynamic business needs.

Top Alternatives to Stripe for Indian Businesses

Now that Stripe is not an option due to its invite-only stance in India, below alternatives step in to help Indian businesses manage cross-border payments efficiently:

PayPal

Why It’s Popular: Trusted globally, PayPal is one of the most popular solutions out there for cross border payments.

Pros: Easy setup, multi-currency support, good success rates and widespread client familiarity.

Cons:

High fees — 9% & poor exchange rates.

Account freezes are also a common complaint.

PayPal does not have a support team in India.

No invoicing solution

Does not handle Sales Tax

Does not provide alternate payment methods.

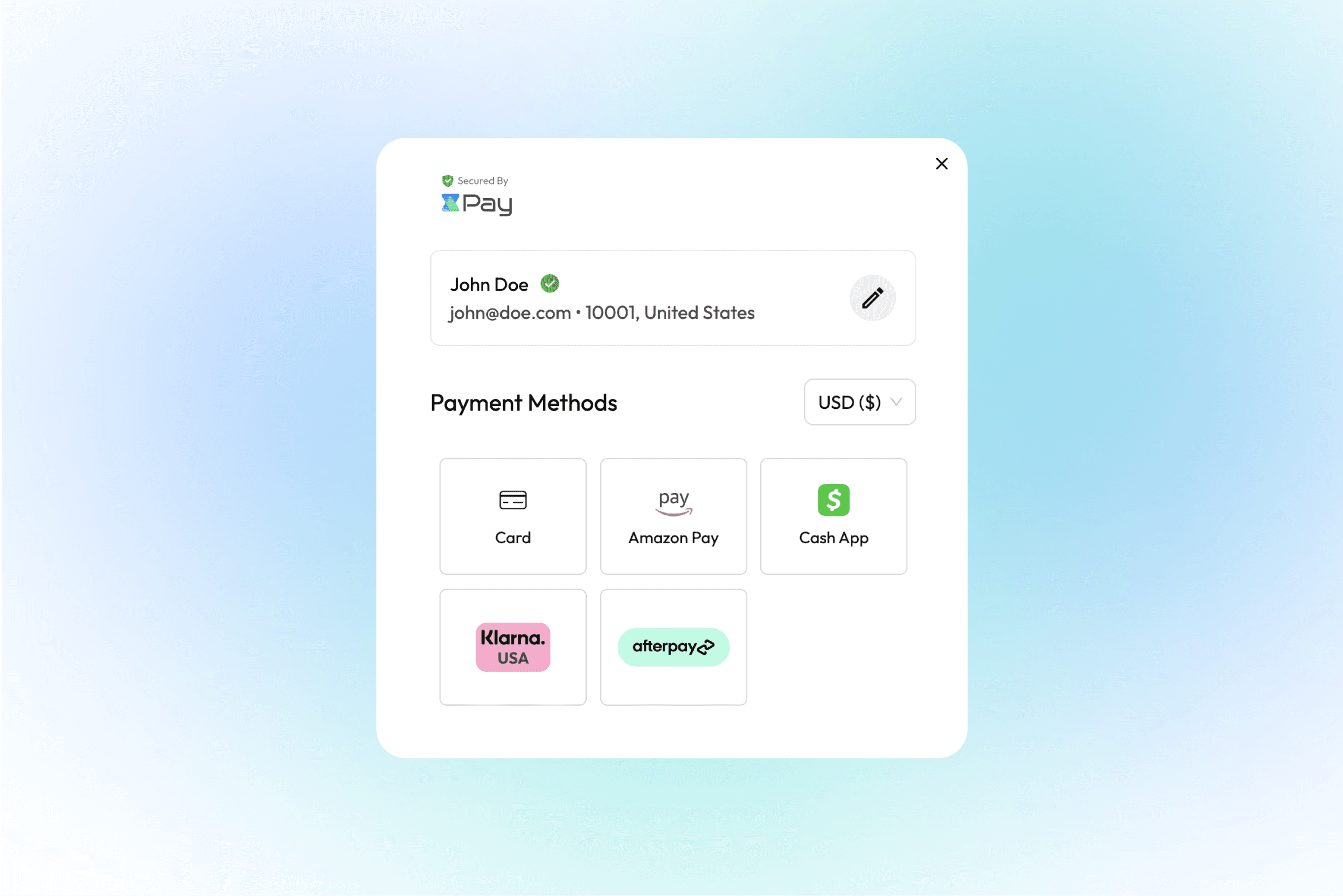

xPay

Why Consider It: YC-backed Enterprise-grade solution for Indian businesses, xPay simplifies cross-border payments with features tailored to meet foreign regulations.

Pros:

Best in market fees - 50% cheaper (including forex) than the other Payment Gateways

Only Payment Gateway to have 40+ global payment methods like Apple Pay, Klarna, Cash App etc.

End-to-end Sales Tax handling

10 min support SLA

Easy integration

No GST/TDS on our fees

Instant FIRCs

Only Indian Payment Processor with 90%+ Success Rates

Razorpay

What It Offers: A homegrown payment gateway, Razorpay supports both domestic and international transactions.

Pros: Integration-friendly APIs and decent support because it is an Indian Payment Gateway.

Cons:

Upto 50% failure rates, especially high in developing markets

Platform fees + Forex fees come up to 8%

18% GST applicable on their fees additionally.

Does not handle Sales Tax

Does not provide alternate payment methods.

Cashfree Payments

What Stands Out: Same as Razorpay, it supports both domestic & international payments.

Pros: Cashfree Payments offers easy integration for both Indian and international businesses. Also decent Customer support.

Cons:

Fees are similar to Razorpay, 8%+

Can’t use it for subscription payments

18% GST applicable on their fees

Does not support alternate payment methods

Does not handle Sales Tax

High failure rates (up to 50%)

Payoneer

Who Uses It: Freelancers and SMEs needing global payment accounts.

Pros: Low-cost withdrawals, multi-currency accounts, and no additional VAT.

Cons:

Delayed payouts and hefty payout fees

Does not provide instant FIRCs.

Can’t use it for subscription payments

Does not handle Sales Tax

Does not provide alternate payment methods.

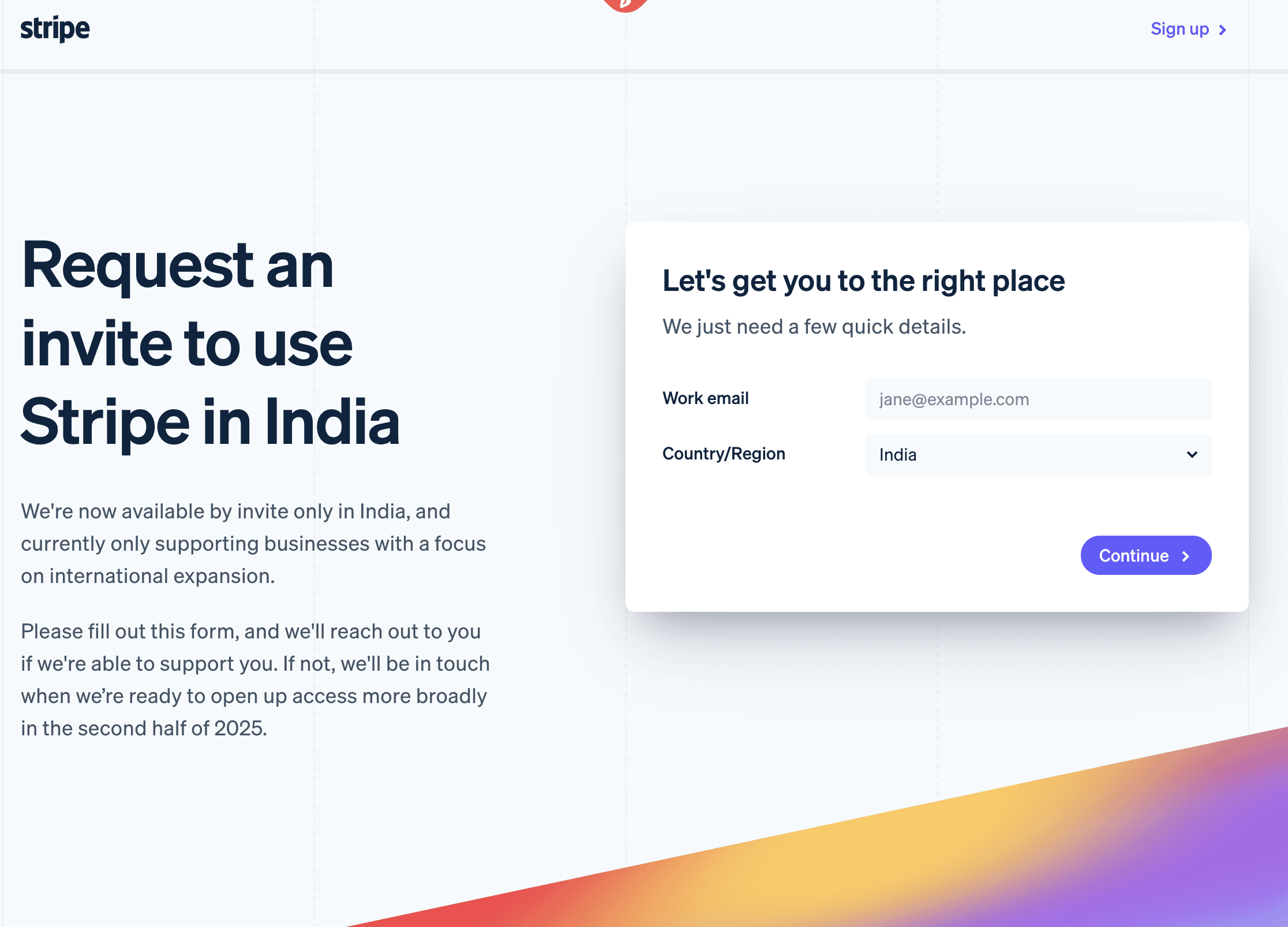

Why Stripe isn’t ideal for an Indian Business?

Stripe's New Rules: The Invite-Only Dilemma

As of mid-2024, Stripe India no longer accepts new businesses without an invitation, creating a major hurdle for Indian companies. The alternative — setting up an overseas entity — comes with complex regulations, legal paperwork, high costs, and operational challenges in a foreign jurisdiction (Read more about it on here). For many Indian Public Companies & Late Stage startups, the process feels insurmountable due to regulatory pressures.

Sales Tax: A Complex Puzzle

Think of GST in India; in the U.S., it’s sales tax. While Stripe calculates what you owe, it stops there — it doesn’t collect, file, or pay it for you. You’re on your own to navigate multiple tax deadlines and staying compliant, failure to do so can cost you up to 25% of the tax amount as penalty + up to a whopping 40% interest.

High Fees: A Margin Killer

Stripe India's platform fees typically range between 4–6%, but once you factor in forex charges, the total cost can climb to nearly 7% per transaction. For enterprises this eats up the top line.

Customer Support Woes

Since Stripe is no longer based in India, its customer support has faced criticism for slow response times and difficulty in addressing issues promptly. This can be especially frustrating when dealing with cross-border payment complexities that require quick resolutions.

Our Recommendation

Stripe’s limitations might feel like a roadblock, but they’re really an opportunity to explore better-suited options for Indian businesses. While alternatives like PayPal, Razorpay, and Payoneer have their merits, they often experience high failure rates and don’t handle your sales tax obligations.

Due to these reasons, new-age solutions like xPay — which take care of your sales taxes and give you 90% success rates, all-while being 50% cheaper than other solutions — are worth a look.

You can contact xPay here.